Access a growing global sector

HACK provides access to a portfolio of leading companies from around the world who are working to reduce the impact of cybercrime.

Portfolio diversification

In one ASX trade, gain exposure to a diversified portfolio of global cybersecurity companies, from a wide range of global locations.

Cost-effective

With management fees of only 0.67% per annum, or $67 for every $10,000 invested, HACK is a cost-effective solution for investors.

Simple to access

Investors can buy or sell HACK as they would any regular share on the ASX using an online brokerage account or financial adviser.

Why consider Cybersecurity in your portfolio?

Globally, data is being generated at a staggering pace, and the need to protect it from cybercrime has never been greater. As a result, cybersecurity has emerged as one of the leading segments in the broader technology sector.

Data also suggests it could be one of the most durable technology investment themes over the long-term, presenting a compelling investment case for growth-orientated investors.

Uber

October 2016

50 million users accounts divulged worldwide

Equifax

May - June 2017

The biggest data breach in recent history - 143 million consumers affected

2018

Security breach affects 50 million users – company logs off 90 million accounts as a precaution.

Under Armour’s MyFitnessPal App

2018

4 million Aussie accounts in data breach – 150 million impacted worldwide

Source: Nasdaq, CNET, Wired, Reuters, Money, CNN, Forbes

Why is Cybersecurity important?

Cybersecurity is a segment of the technology industry which focuses on products and services to protect computers, networks, programs, and data from unauthorised and unintended access.

Cybercrime encompasses everything from phishing, malware and viruses, to general data theft and disruption of service attacks.

The cost of recovering from a severe security breach can run into millions of dollars. No-one is immune.

Investing in cybersecurity is no longer optional for businesses, governments and other organisations - in today’s online world, it’s essential.

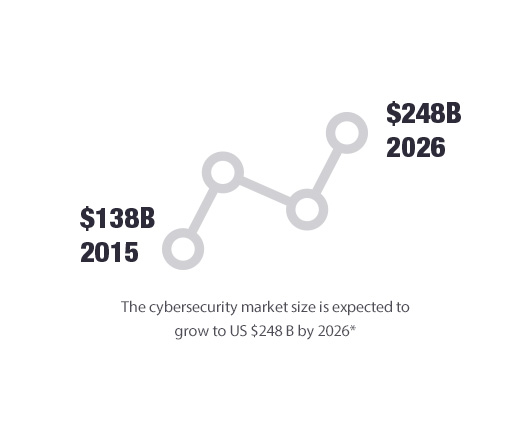

The outlook for Cybersecurity

The global cybersecurity market is currently worth ~US $140 billion and is forecast to increase to US $248 billion by 2026*.

This suggests as cybercrime costs continue to rise, so will overall spending for cybersecurity measures. Investing in cybersecurity can be a smart way to seek to profit from the growing threat of cybercrime, cyber-attacks and data breaches.

*Australian Cybersecurity Growth Network, Sector Competitiveness Plan 2018

Diversification opportunity

Cybersecurity is a sector under-represented in the Australian sharemarket and exposure to cybersecurity may particularly benefit Australian investors seeking further diversification away from Australian holdings.

Investors seeking exposure to the growth opportunities in the cybersecurity sector can do so in a single ASX trade with the BetaShares Global Cybersecurity ETF (ASX: HACK).

Request an info pack to learn more.

REQUEST AN INFORMATION PACKBenefits of the BetaShares

Global Cybersecurity ETF (ASX: HACK)

HACK is the only fund available on the ASX offering investors specific exposure

to the exciting growth prospects in the global cybersecurity sector.

Additionally, HACK helps ease single stock picking burden by offering exposure

to a diversified portfolio of companies, in one trade.

Performance update

In the 3 years to end June 2020, HACK’s index has returned 20.3% p.a. The companies that make up the index have generated 1-year revenue growth that is approximately 5.3 times that of the companies in the Australian sharemarket.

*Past performance is not indicative of future performance.

Key facts

- Asset class: International Shares

- Management fees: 0.67% p.a ($67 for every $10,000 invested)

- Size of Fund: ~$213m*

- How to invest: Just like all BetaShares' funds, HACK can be bought and sold on the ASX.

- ASX Code: HACK

*As at June 2020.

Access

A simple way to access a diversified portfolio of the world's leading cybersecurity companies.

Diversification

In a single trade gain exposure to a diversified portfolio of cybersecurity companies from a range of global locations.

Cost-effective

With management fees of only 0.67% per annum, or $67 for every $10,000 invested, HACK is a cost-effective solution for investors.

Invest in global giants and emerging leaders

Strategy invests in both existing marquee names as well as emerging players in the cybersecurity industry.

Liquidity

Investors can buy or sell HACK as they would any share on the ASX.

Transparent

View the full list of companies in HACK's portfolio at any time on the BetaShares website.

HACK can be used to implement a variety of investment strategies, for example:

Tactical exposure to the global cybersecurity sector

A core component of a global shares allocation

Gain access to the world’s leading cybersecurity companies

Examples of companies in HACK's portfolio

- Cisco

- Akamai

- VMware

- Fortinet

- Symantec

- CyberArk

- Varonis

- SAIC

- Palo Alto Networks

Learn more about investing in HACK

Just fill in the form and you'll receive an information pack about HACK including

the latest factsheet and portfolio holdings information.